Make a Donation

The historic building is showing its age.

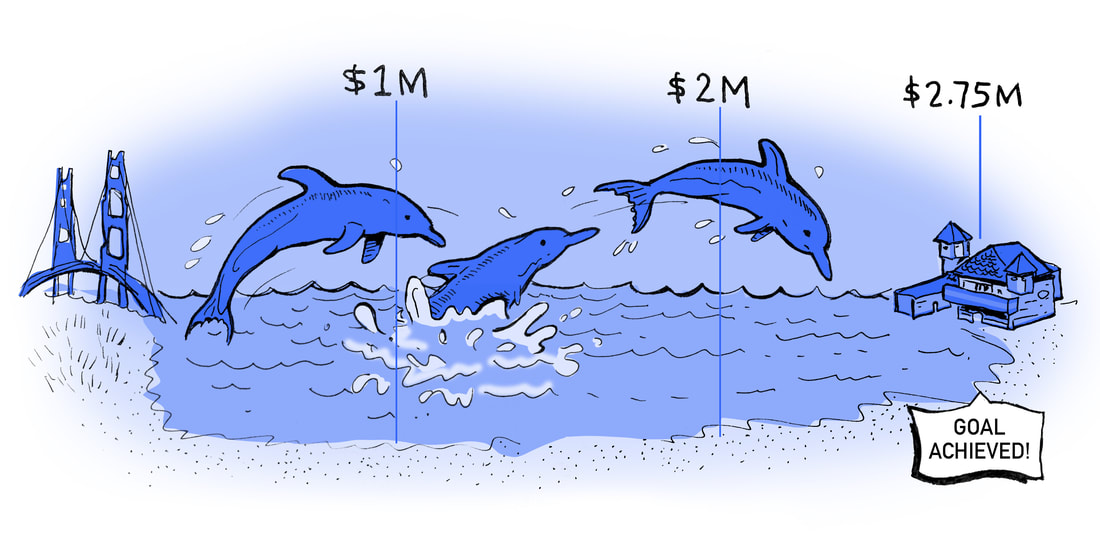

We are planning a big renovation of the old boathouse, including building a new foundation for the gym and galley, renovating the galley and updating the infrastructure of the building. The costs are substantial and we are asking you to kindly contribute to the upkeep and renovation of this beloved and historic boathouse.

SUMMER 2023 UPDATE:

WE DID IT!

More than 720 members of the Dolphin Swimming and Boating Club community generously donated to our renovation project. During the summer of 2023 we reached the fundraising goal of $2.75 million.

The Dolphin Swimming and Boating Foundation extends a huge amount of gratitude to each member of the community who contributed to achieving this goal.

We also want to recognize our Fundraising Committee Co-Chairs, Anthony DuComb and Robin Rome. Without their extraordinary efforts this would not have been possible.

While fundraising goals specific to the renovation have been reached, the Foundation continues to accept donations furthering its mission to provide publicly-accessible classes and educational programming on swimming, rowing and boat building.

SUMMER 2023 UPDATE:

WE DID IT!

More than 720 members of the Dolphin Swimming and Boating Club community generously donated to our renovation project. During the summer of 2023 we reached the fundraising goal of $2.75 million.

The Dolphin Swimming and Boating Foundation extends a huge amount of gratitude to each member of the community who contributed to achieving this goal.

We also want to recognize our Fundraising Committee Co-Chairs, Anthony DuComb and Robin Rome. Without their extraordinary efforts this would not have been possible.

While fundraising goals specific to the renovation have been reached, the Foundation continues to accept donations furthering its mission to provide publicly-accessible classes and educational programming on swimming, rowing and boat building.

For your convenience we have set up several easy ways you can make a donation

Send a Check

Please make checks payable to the Dolphin Swimming and Boating Foundation and send to: Dolphin Swimming and Boating Foundation 502 Jefferson Street San Francisco, CA 94109 Please include in your check's memo line whether you'd like the donation to apply to the Building Renovation, the Dolphin Youth Swim Fund, or the Foundation's highest needs

|

Use a Credit or Debit Card

Click the Donate Button to make a secure donation Planned GivingThe Dolphin Swimming and Boating Foundation Commodore Club was formed to recognize and thank those who have included the Foundation in their estate plans through a bequest, life income plan, or other type of planned gift.

To make a planned gift, please complete this form. |

Donate Appreciated Securities

If you have unrealized gains in your taxable portfolio accounts, consider making charitable contributions of appreciated stock instead of cash. A gift of appreciated stock that has been held for more than one year generally can provide a double benefit by allowing the taxpayer to receive the charitable contribution deduction equal to the stock's fair market value on the date of contribution, and excluding from taxable income the gain on the stock appreciation which would normally be taxed at the capital gain rates of 15% or 20% depending on the tax bracket of the donor. Contact [email protected] for more information.

If you have unrealized gains in your taxable portfolio accounts, consider making charitable contributions of appreciated stock instead of cash. A gift of appreciated stock that has been held for more than one year generally can provide a double benefit by allowing the taxpayer to receive the charitable contribution deduction equal to the stock's fair market value on the date of contribution, and excluding from taxable income the gain on the stock appreciation which would normally be taxed at the capital gain rates of 15% or 20% depending on the tax bracket of the donor. Contact [email protected] for more information.

The Dolphin Swimming and Boating Foundation, a registered 501(c)(3) charitable organization is committed to preserving the boathouse for current and future generations. Donations are tax-deductible to the fullest extent allowed by law.

EIN #82-4883113

EIN #82-4883113